Nike missed expectations for earnings on Thursday, but analysts were still impressed with the company’s progress in North America, DTC sales and clearing through excess inventory.

The athletic giant reported Q4 revenues were $12.8 billion, up 5 percent compared to 2022. For the full year, revenues were $51.2 billion, up 10 percent over the prior year. Nike also saw growth in Greater China and North America, two key regions analysts were watching for recovery.

Looking ahead, Nike expects fiscal year 2024 revenues to grow in the mid-single digits, accounting for headwinds from the wholesale shipping timing from the prior year. In Q1, Nike expects revenues to be flat to up in the low single digits due to its efforts to reduce excess inventory.

“While there’s still some cleanup of the marketplace that needs to occur, we see a lot to like here,” wrote Wedbush analyst Tom Nikic in a note to investors.

Below, we outline three key wins from Nike’s recent results, which analysts say could mean good things for the brand in fiscal year 2024.

Inventory progress

Inventories, a key concern for analysts, were flat year-over-year at Nike for the period ending in May.

“Our inventory levels are ahead of our plan and ahead of the competition,” said Nike CFO Matthew Friend in a call with analysts. “We feel great about where we are, but we recognize that, next year, the environment is going to continue to be promotional, and that even puts pressure on our wholesale partners in terms of how they think about managing through the first half of the year.”

However, while inventories were down year-over-year, they were still more than 20 percent above 2021 levels, managing director of GlobalData Neil Saunders pointed out in a statement. This is due to a slowdown in consumer demand, which has pushed Nike to re-enter into partnerships with Macy’s and DSW.

“This softness does not look like it will dissipate any time soon and this represents a challenge for Nike as it cannot make up for all the deterioration through its direct sales channels,” Saunders wrote, adding that Nike is “a solid brand” that will need to focus on resetting business in 2024.

Jordan’s record year

Nike’s Jordan brand had a record year in 2023, with sales growth above 30 percent year over year.

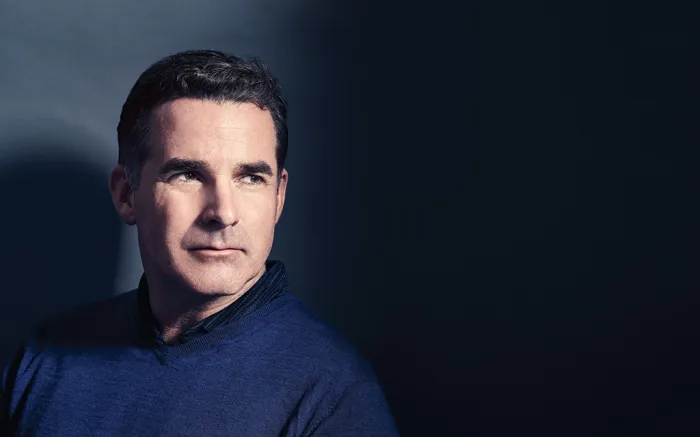

“Jordan is well on its way to becoming the second largest footwear brand in North America,” said Nike CEO and president John Donahoe in a call with investors, highlighting the opportunity for international penetration: Jordan brand penetration is 10 points lower than North America than in many geographies outside of the continent.

Notably, Jordan brand growth in performance footwear is now outpacing retro styles.

DTC progress

In Q4, Nike Direct revenues were up 15 percent to $5.5 billion and wholesale revenues were $6.7 billion, down 2 percent. Analysts were overall optimistic about the progress with Nike’s Consumer Direct Acceleration (CDA) strategy, which Donahoe lauded as a success.

“We believe Nike’s shift to a digital-led positioning behind its Consumer Direct Acceleration strategy, which appears largely unchanged, can support a return toward the company’s attractive growth algorithm over time,” wrote Baird analyst Jonathan Komp in a Friday note.

Third Bridge analyst Shoggi Ezeizat also called out Nike’s DTC growth.

“Nike’s focus on direct-to-consumer sales is boosting its profitability during a period of difficult supply constraints,” Ezeizat said. “However, our experts suggest that Nike has also recognized the importance of maintaining a healthy wholesale marketplace so that it can reach a diverse range of consumers.”

At the same time, Nike has recently begun pushing more inventory into wholesale channels such as DSW, Foot Locker and Macy’s to offload excess inventory. Nike has attributed this shift to meeting different consumers at the various channels they shop in.

+ There are no comments

Add yours